Senate Passes Scott-Led Effort to Repeal Biden-Era CFPB Overdraft Rule

The rule would have led to reduced access to credit and important financial services for hardworking Americans.

Washington, D.C. – Today, the Senate passed Chairman Tim Scott’s (R-S.C.) Congressional Review Act (CRA) resolution to overturn the Biden administration Consumer Financial Protection Bureau’s (CFPB) final rule imposing new price controls on overdraft services offered by banks and credit unions. The rule would have led to reduced access to credit and important financial services for hardworking Americans.

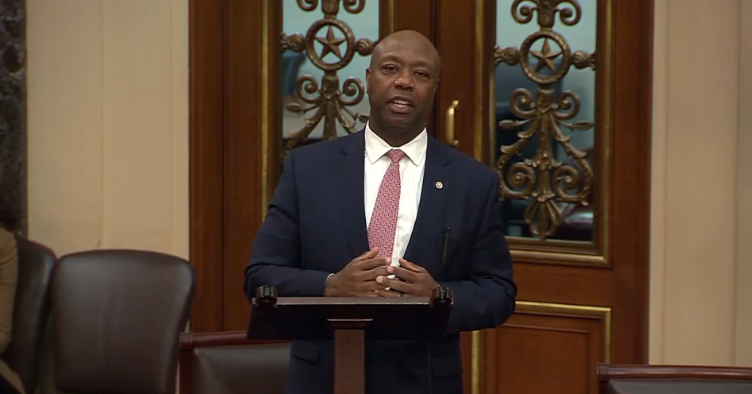

Last night, Chairman Scott delivered remarks on the Senate floor emphasizing that the rule would have resulted in more unbanked Americans and fewer options for consumers.

Click here or on the image above to watch Chairman Scott’s remarks.

Chairman Scott’s full remarks as delivered:

Mr. President, I rise to talk in favor of my CRA on the overdraft fees.

President Biden’s politically motivated “junk fee” conversation was not about helping consumers. It was about trying to change the conversation away from the devastation that inflation was bringing to kitchen table after kitchen table after kitchen table all across America.

The average American, because of Bidenflation, lost a thousand plus dollars in spending power.

Devastated by the Biden economy, President Biden looks for something to change the conversation.

And he changes it to something called “junk fees.”

One of the junk fees he talked about was the overdraft fee. Now some will say, “what is an overdraft fee?”

Your bank account goes beyond zero, you have to pay a fee, your bills are paid.

Some people will say that people who live paycheck to paycheck use their overdraft option to pay their rent.

So, when you start capping this fee structure, you start eliminating overdraft. You start eliminating the possibility of people working paycheck to paycheck to make the decision to continue to use their resources in the most effective way.

Unfortunately, President Biden’s devastating economy has reverberated for years now.

This overdraft conversation is a critically important conversation if you are like me, a guy who grew up in poverty, a single parent household, who understands the difficulty, the challenge, of single moms making those ends meet.

I want every single hardworking American to have access to our financial system.

That sometimes includes, as it did for us, free checking. A free checking account is not free, but with the revenue streams coming into the institutions, they can use those revenues as an option to provide free checking for those living paycheck to paycheck.

Overturning the Biden CFPB’s overdraft fee structure is good for consumers.

And let me just quote from the Federal Reserve Bank of New York that confirmed the overdraft fees cap hinders financial inclusion.

As a study stated, “…overdraft fee caps hinder financial inclusion. When constrained by fee caps, banks reduce overdraft coverage and deposit supply, causing more returned checks and a decline in account ownership among low-income households.”

To do the right thing for the working class is to give them all the options and let them decide. Trust them with their own resources.

That is in the best interest of our nation and that is why I am offering this CRA tonight.

###

Next Article Previous Article